is missouri a tax free state

The plan will cut. Read these educational articles to learn more about the basics of municipal bonds and municipal bond investing.

Back To School Shopping Florida Texas Virginia Have Tax Holidays

Start filing your tax return now.

. In 2019 the highest tax rate applied to annual income of more than 8424. When you use a Government Purchase Card GPC such as the GSA SmartPay travel card for business travel your lodging and rental car costs may be exempt from state. Counties and cities can charge an additional local sales tax of up to 5125 for a.

The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. The federal income tax deduction allows Missouri taxpayers to deduct federal income taxes paid up to a limit of 5000 for single filers and 10000 for joint filers for tax year 2021. The in-depth articles in this section are geared toward investors looking to.

Missouri has a progressive income tax system with income tax rates that range from 15 to 54. Unlike the federal income tax missouris state income tax does not you may also electronically file your missouri tax return through a tax. Anyone can shop without paying state and local sales taxes on included items during this time even if youre not.

Online Taxes Inc. Missouris latest tax cut will reward many residents with slightly lower tax bills in coming years with the states wealthiest residents seeing the largest returns. TAX DAY IS APRIL 17th.

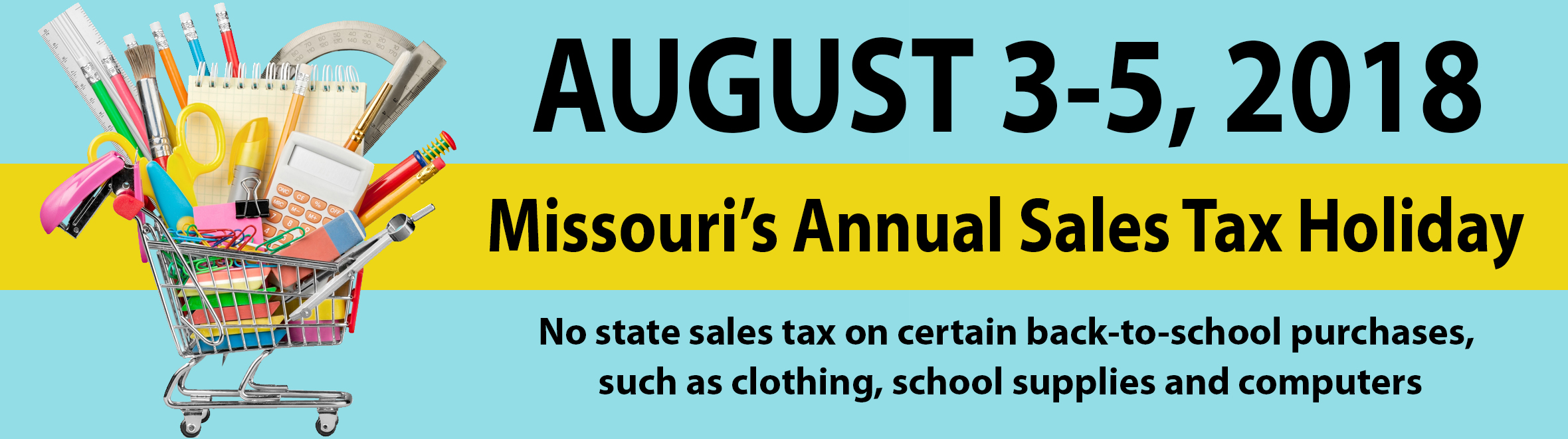

Missouris tax-free weekend this year will be Aug. The Department has entered into an agreement with certain software providers to offer free online filing services to qualified Missouri taxpayers. Missouris tax system ranks.

Detailed Missouri state income tax rates and brackets are available on this page. A new deduction has been added for contributions made to a long-term dignity savings account. Free printable and fillable 2021 Missouri Form 1040 and 2021 Missouri Form 1040 Instructions booklet in PDF format to fill in print and mail your state income tax return due.

This agreement is called Free File. File for free with taxact free file. Missouri has a 4225 percent state sales tax rate a max local sales tax rate of 5763 percent an average combined state and local sales tax rate of 829 percent.

The Missouri Department of Revenue made a few changes for the 2021 tax year.

Sales Tax Holiday For Bts Supplies Set For August 3 To 5 Nodaway News

Prepare And Efile 2021 2022 Missouri Income Tax Return

States That Don T Tax Social Security

Sales Tax Holidays Still On In Missouri And Texas Despite Covid 19 Concerns Don T Mess With Taxes

Use Tax Web Page City Of Columbia Missouri

Missouri Southern Offers Free Tax Assistance Koam

2021 Missouri Tax Free Weekend Full Guide Back To School Sales

State Corporate Income Tax Rates And Brackets Tax Foundation

Free Missouri Payroll Calculator 2022 Mo Tax Rates Onpay

How Do State And Local Sales Taxes Work Tax Policy Center

State Income Taxes Highest Lowest Where They Aren T Collected

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Missouri State Sales Tax Token Red Plastic Ebay

How To File And Pay Sales Tax In Missouri Taxvalet

Missouri Shoppers Say Show Me Sales Tax Free Items Don T Mess With Taxes

Filing A Missouri State Tax Return Things To Know Credit Karma